Over the last few decades, the global and Indian IT industry has witnessed decent growth as the businesses got intertwined with technology like never before. And with ever evolving technological advancement, constant evolution and innovation with increasing need for digitization of products and processes; global IT industry is all set to benefit from these newer growth opportunities

Emerging technologies like cloud, AI / ML, IoT, robotics, blockchain, and few others to drive a new wave of demand for the global IT companies globally.

Greater emphasis on technological transformation across industries to drive demand for ER&D globally in the future

Shift toward digital first, platformization and enhanced customer experience (CX) will be the key growth drivers moving forward.

Engineering process are going through efficiency improvements across value chain along with the structural changes that may help improve the overall margins for technology companies in the short to medium term

Covid-19 has accelerated growth of the global IT companies with rise in digitization demand. This trend may continue for the next 2-3 years as more and more companies are going digital.

With a market share that rose to 35% in 2024, up from 15%, the Indian IT industry continues to be a major force in the global market. This growth, largely driven by exports, further solidifies the world’s recognition and trust in the potential of Indian IT companies (Source: BNP Paribas)

The government initiatives like Digital India and Startup India are likely to strengthen the digital transformation & local demand

India being the second-fastest digital adopter among 17 major digital economies, opening up newer opportunities in the domestic market

India is home to a significant portion of the global digital talent pool. As of 2024, Indian IT companies continue to be major employers in the economy, with hiring expected to grow by 8-10%. This underscores the world’s recognition and trust in the potential of Indian IT companies, which are majorly export driven. Source: Economic Times

Source:McKinsey & Company

A fund that aims to capture opportunities in IT and related businesses

The fund invests across market caps in IT sector in India and Overseas

The fund uses GARP approach (Growth at areasonable price) for stock selection

Invests in fundamentally strong companies from Information Technology Sector

The fund uses GARP approach (Growth at areasonable price) for stock selection

Invests in fundamentally strong companies from Information Technology Sector

A fund that can help you diversify your investments across geographies and currencies in IT Sector

A fund that can help you diversify your investments across geographies and currencies in IT Sector

A well-diversified portfolio within IT and related businesses

Investors aiming to benefit from the thriving IT industry in India and across the globe

Investors

seeking

capital growth over a

longer period of time and

diversify

Investors willing

to take higher risk and invest in

sectoral scheme

| Scheme Name | Tata Digital India Fund |

| Investment Objective | The investment objective of the scheme is to seek long term capital appreciation by investing at least 80% of its net assets in equity/equity related instruments of the companies in Information Technology Sector |

| Type of Scheme | An open-ended equity scheme investing in Information Technology Sector |

| Fund Manager | Meeta Shetty (Managing Since 09-Nov-18 and overall experience of 17 years), Kapil Malhotra (Managing Since 19-Dec-23 and overall experience of 14 years) |

| Benchmark | NIFTY IT TRI |

| Min. Investment Amount | Rs. 5,000/- and in multiples of Re. 1/- thereafter |

| Load Structure | Entry Load: Nil. Exit Load:

|

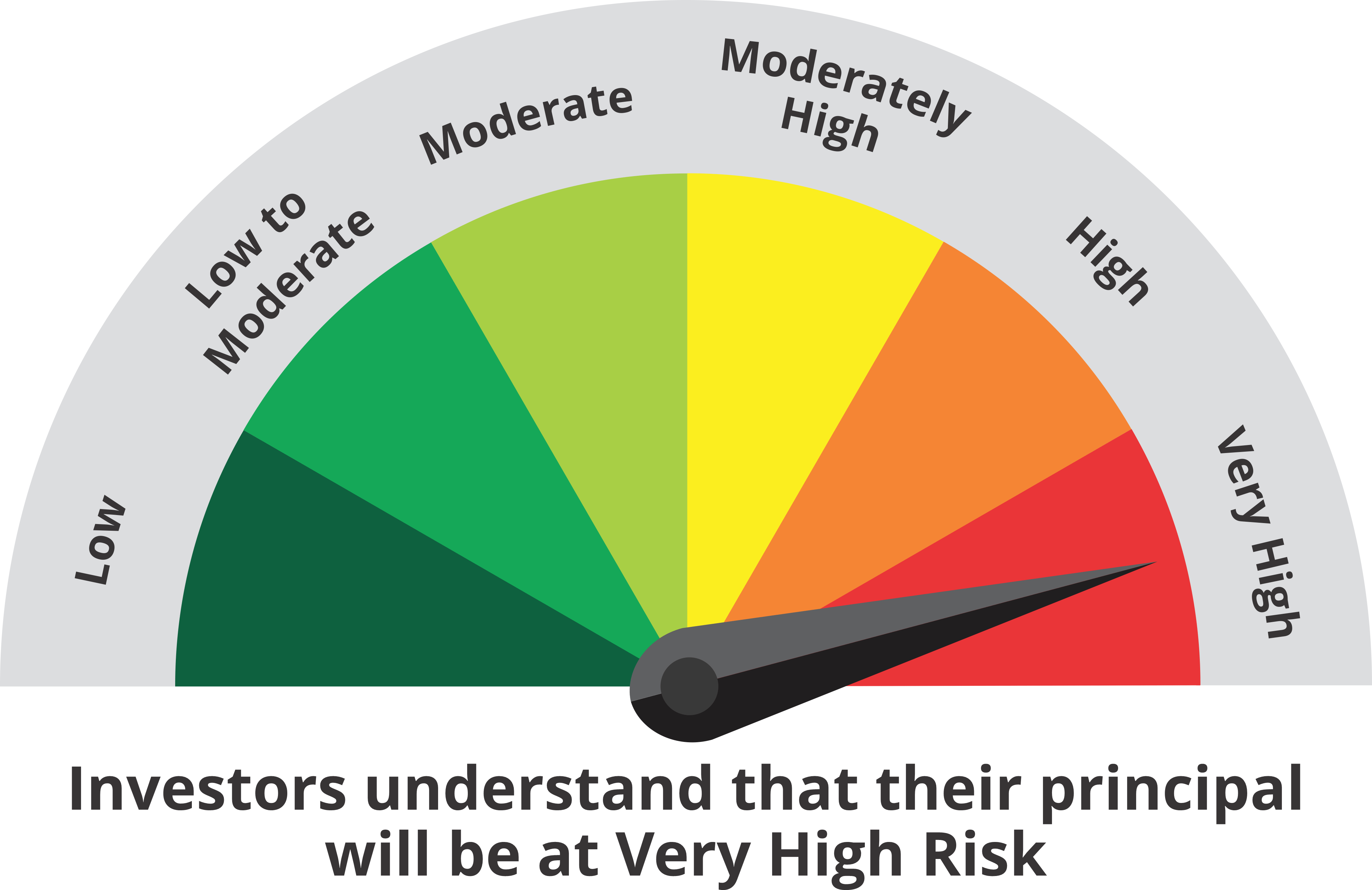

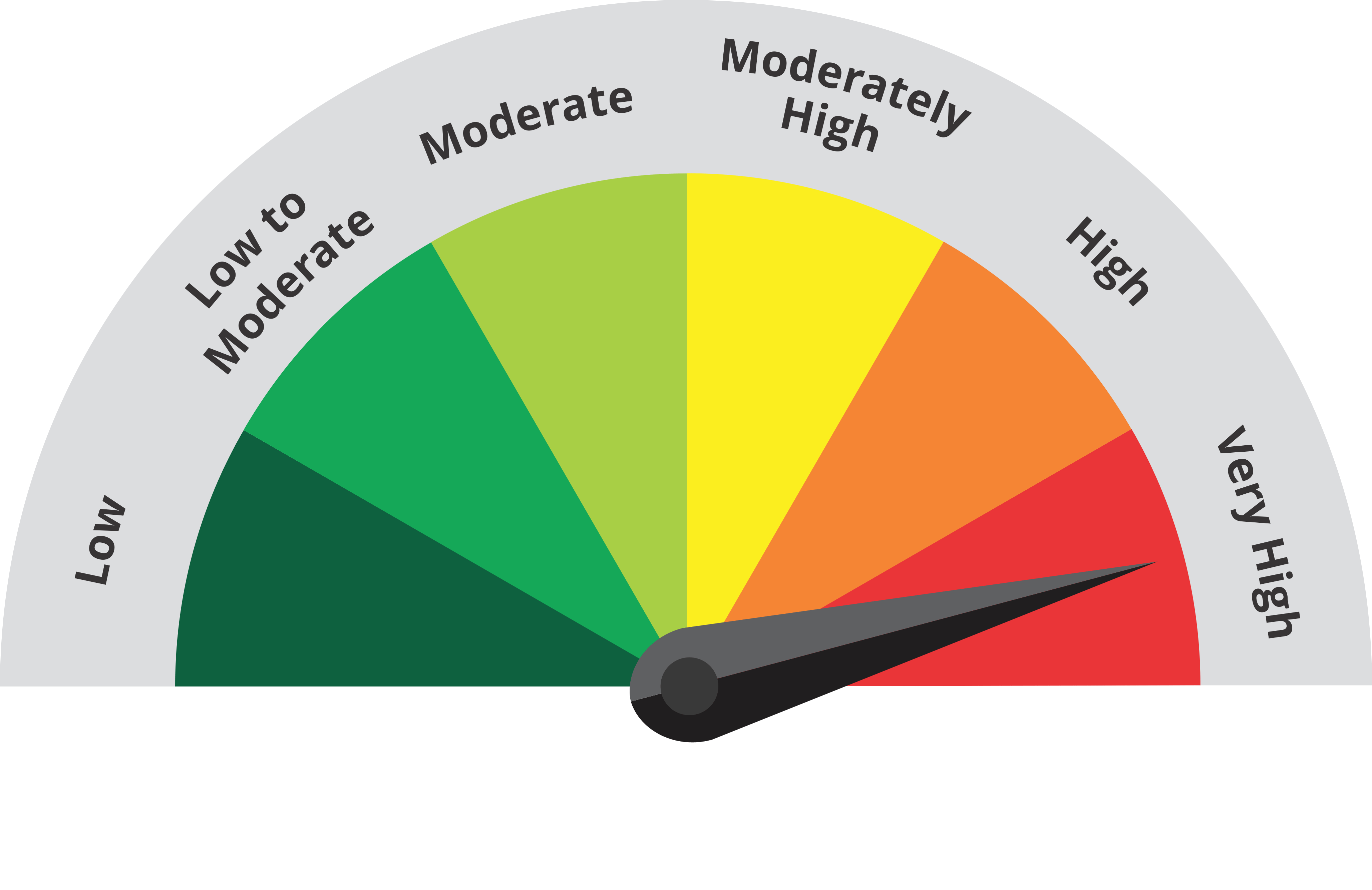

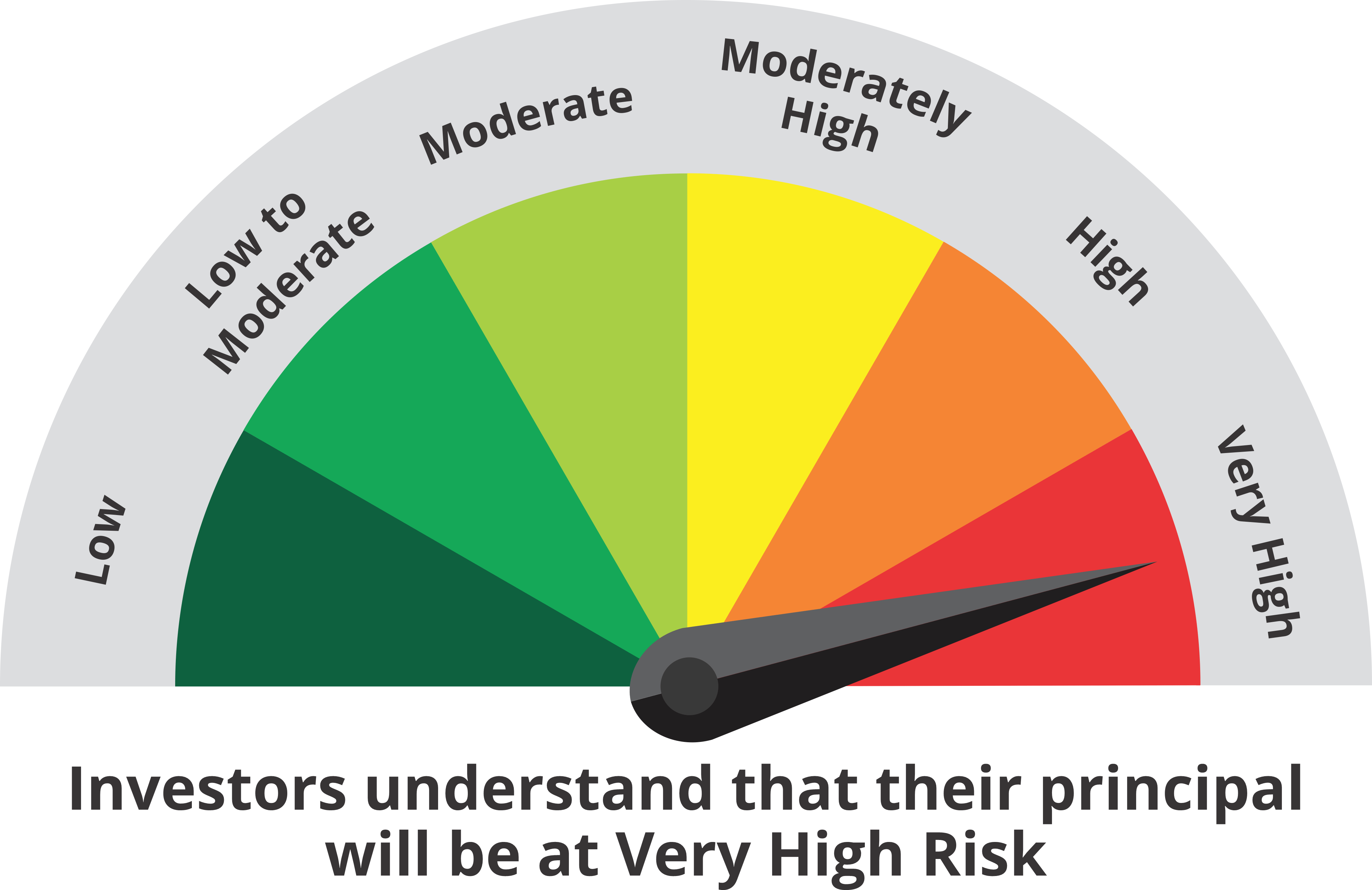

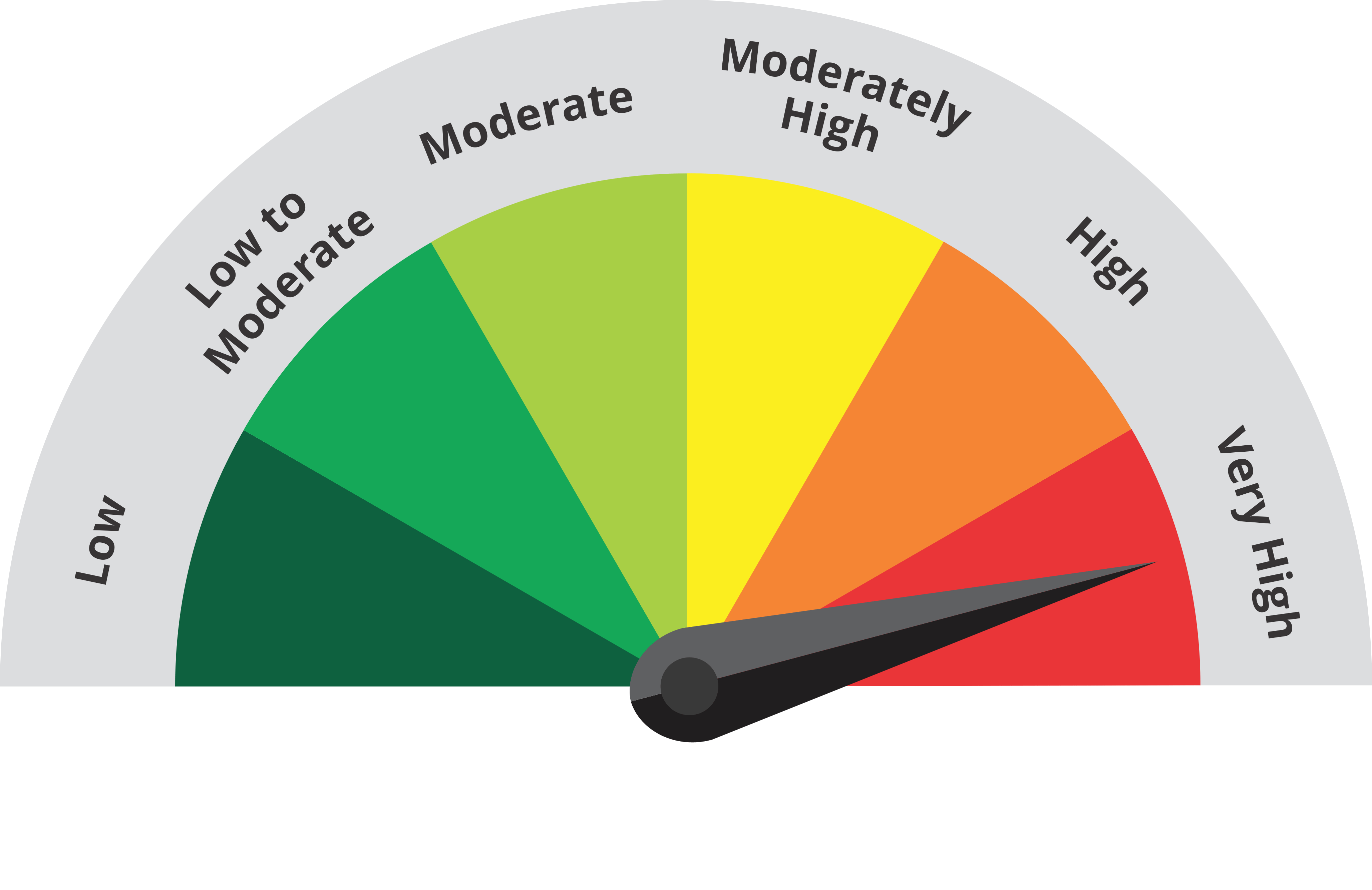

| Product Label | Scheme Risk-O-Meter | Benchmark Risk-O-Meter |

|---|---|---|

|

This product is suitable for investors who are seeking*:

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them |

|

|

This product is suitable for investors who are seeking*:

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them

(It may be noted that risk-o-meter specified above is based on the schema characteristics. The same shall be udpated in accordance with provision no 17.4.1.i of SEBI circular on Mutual Fund dated may 19, 2023 on product labelling in mutual fund schemes on ongoing basis)

Corporate Office Address:

Tata Asset Management Private Limited, 19th floor, Parinee Crescenzo, ‘G’ Block, Bandra Kurla Complex, Opposite MCA Club, Bandra (E), Mumbai – 400051